October may be most popular for spooky fun associated with Halloween, but it’s also Cybersecurity Awareness Month, a time to ramp up your protection against scary scammers. Cybercrimes are at an all-time high with tricksters using ever-more sophisticated techniques to rob consumers of money and personal information.

An increased reliance on digital platforms for everything from banking to shopping to communicating with family can make users vulnerable to fraud, identity theft and other scams. These threats are driven by artificial intelligence (AI) and highly convincing phishing calls, emails, text messages, and deepfake videos that are nearly indistinguishable from genuine communications.

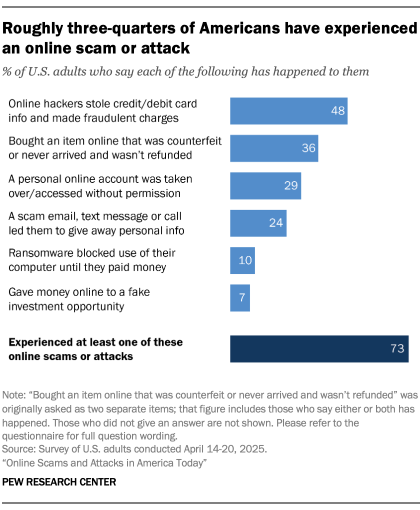

At least 73% of U.S. adults have experienced an online scam or attack, according to a report from the Pew Research Center published on July 31, 2025. A majority of U.S. adults are being contacted by scammers at least weekly.

Bad habits can haunt you

Most consumers cite cybersecurity threats as a top concern, but their behavior hasn’t caught up with awareness. Are you guilty of these risky technology habits that can expose you to potential malicious software or phishing attempts?

- Using the same password across multiple accounts.

- Clicking on unsolicited links in emails, texts or social media.

- Downloading unverified apps or accepting friend requests from strangers.

- Failing to use basic security measures like antivirus software, multi-factor authentication or ad blockers.

- Reusing logins or sharing personal data to get deals.

- Using unsecured public Wi-Fi networks in places like coffee shops and airports.

- Revealing too much personal information on social media.

Don’t fall for the fake

Hiding behind masks and costumes is fine for young trick-or-treaters, but don’t let scammers use similar techniques to steal from you. Phishing scammers hide behind fraudulent emails and fake websites to trick users into disclosing private account or login information.

The Georgia Bankers Association urges consumers to watch for these red flags of phishing:

- Suspicious links and email addresses. Scammers often use slight variations in URLs or email addresses to deceive you.

- An unexpected email or text message that looks like it’s from a company you know or trust, like a bank or utility company.

- Directions to open an unsolicited link or attachment.

- Urgent or fear-inducing language meant to pressure you to act immediately.

- A request for personal information. Legitimate companies will not ask for your Social Security number, bank account details or passwords over the phone or in an unsolicited message.

- Demand for payment via a payment app, gift cards, cryptocurrency or wire transfers.

Forward phishing emails to reportphishing@apwg.org — and to the company, bank or organization impersonated in the email. To report a phishing attempt to the Federal Trade Commission (FTC), visit ReportFraud.ftc.gov.

Protect yourself

The Georgia Bankers Association also recommends these tips to keep you safe online:

- Update computers and mobile devices. Having the latest security software, web browser and operating system are the best defenses against viruses, malware and other online threats. Turn on automatic updates so you receive the newest fixes as they become available.

- Set strong passwords. A strong password is at least eight characters in length and includes a mix of upper and lowercase letters, numbers and special characters.

- Keep personal information personal. Hackers can use social media profiles to figure out your passwords and to get answers to security questions for the password reset tools. Lock down your privacy settings and avoid posting things like birthdays, addresses, mother’s maiden name, etc. Be wary of requests to connect from people you do not know.

- Secure your internet connection. Always protect your home wireless network with a password. When connecting to public Wi-Fi networks, be cautious about what information you are sending over it.

- Shop safely. Before shopping online, make sure the website uses secure technology. When you are at the checkout screen, verify that the web address begins with https. Also, check to see if a tiny, locked padlock symbol appears on the page.